As the whole world was on the precipice of the COVID crisis and its effects, a lot of remarkable impacts were registered in business history as a whole. This impact can also be seen in the insurance industry as the pandemic had its toll on this key sector. Insurance businesses worldwide faced many challenges during the pandemic.

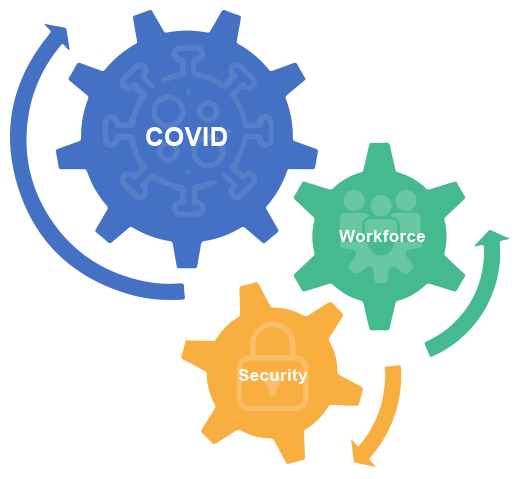

In this article, we focus on three main challenges facing the insurance industry in 2022. The first one has to do with the direct impact of the pandemic itself while the other two relate to how the pandemic created or intensified the need for workforce expansion and better cybersecurity.

The Pandemic

Generally, the biggest obstacle facing the Insurance sector nowadays is adapting to the new circumstances brought about by COVID-19. Beyond the economic issues such as turbulence in interest rates and equity markets, uncertain government policies, and deteriorating investment opportunities, there are other issues. The new realm of challenges facing the insurance sector has more to do with the nature of insurance consumers and evolving expectations and concerns.

Workforce Expansion

As insurance companies are working on big economic recovery after the pandemic, there is a big need to find ways to recruit the required human resources. According to a recent survey by Deloitte, insurance companies are expecting to expand their workforce in most of their functional areas. This could necessitate insurance firms to go beyond geographical locations to hire professionals. To fulfil the need, insurance companies would need to diversify the workforce using for example part-time employees and contractors. Moreover, they may even need to lower function-specific requirements to accept less experienced personnel who are willing to learn fast on the job.

Cybersecurity

Another technology-related concern is the evermore challenge of cybersecurity for all business sectors, and insurance is not an exception. According to a Deloitte report, the percentage of attacks that used new malware or methods had risen from 20% to 35% during the pandemic. The gravity of the situation appears even clearer when we consider the upsurge of trends such as remote work and videoconferencing business communications induced by the pandemic. All of these constitute a treasure trove for cybercriminal activities.

For more information on how to mitigate security risks, please refer to our articles on the topic.

Digitalization Can Help

Adapting to these new challenges requires rethinking much of the long-established ways of conducting business, managing daily work activities, and applying technology. The use of technology will bring benefits to the insurance sector to enable it to overcome these challenges. Technology will continue to be the major source for optimizing insurance operations and providing timely services.

Since the pandemic, many insurers had to prompt their digital transformation efforts and look for technologies that can assist and speed up their processes in all areas. Digitalization helped and continues to enable remote teams and overcome many of the restrictions that were imposed by the pandemic. Technology can help not only in coordinating efforts of virtual teams, but also in the recruitment and management of the required personnel. In addition, using advanced technologies and security standards should greatly enhance and help overcome the challenges imposed by cybersecurity.

No comments:

Post a Comment